Pulse of the Market - July 2021

I would like to discuss two topics 1)The scrambling going on behind the scenes with the OCC, DTCC, and SEC 2) How sentiment drives price and the manipulation of message boards & social media

Peeking Under the Hood of the Market: The Scrambling Behind the Scenes

There has been a very expensive, high stakes game of hot potato or to be more crude, Russian Roulette, going on behind the scenes that no one is really discussing. The players are as follows: The Options Clearing Corporation (OCC), the Depository Trust & Clearing Corporation (DTCC), and the Securities and Exchange Commission (SEC).

On their website, The OCC, founded in 1973, is the world's largest equity derivatives clearing organization. OCC is dedicated to promoting stability and financial integrity in the marketplaces that it serves by focusing on sound risk management principles

The DTCC explains their services as such, “Our subsidiaries, DTCC delivers an unmatched suite of services that provide maximum client value, deep market insights and superior risk management across market segments, globally.” Basically, the DTCC provides clearing services, or facilities buy and sells within the stock market.

And lastly, the SEC, as you all know, was created to enforce laws against market manipulation. Alright, so what do these three orgs have in common? They are passing laws left and right trying to limit their exposure to hedge funds blowing up.

Just take a look at all the new regulations passed within the last 6 months. These regulations mainly have to do with how collateral is checked, increasing minimum fund depository requirements, and shortening processing times. So the hedge funds, who are blatantly piling on billions in debt and buying risky call options or shorting stock on a mass scale may finally be checked for their irresponsible practices? Well, if these new regulations are enforced, these bodies can call a hedge fund any time (instead at the end of the month) and make sure they have the required collateral for these insanely risky trades otherwise they will be margin called by the DTCC, OCC, which subsequently ends in the liquidation of their positions and fund.

Who is going to be holding the gun at the end once the inevitable bank, large hedge fund, or even the stock market blows up? Maybe none of them as the Federal Reserve will continue to just print more money.

How Sentiment Drives Price: The Manipulation of Message Boards and Social Media

With high frequency trading and constant noise, it’s easy to become very fearful or very joyful after sudden, large moves up or down in a stock’s price. Most of the noise (or unintelligent opinions) comes from message boards, news sites, and cable television. Given the rise of social media and message boards, they have become the easiest way to manipulate a narrative about a stock with very little effort.

If you didn’t know, most of the yahoo message posters, etc are actually bots, programmed by hedge funds to track sentiment. It’s pretty easy to instill fear or post joyfully in these cesspool of message boards to move the price of stocks up or down quickly. The same thing has happened at the famous reddit site: WallStBets. Back in 2017, when I first joined, there were actual posts of gains and losses, due diligence of stocks, etc. Now most of the posts are bots, pumping random stocks with zero due diligence trying to get retail investors to bite before the inevitable dump after the pump. The SEC chairman even mentioned the manipulative practices of these message boards by hedge funds.

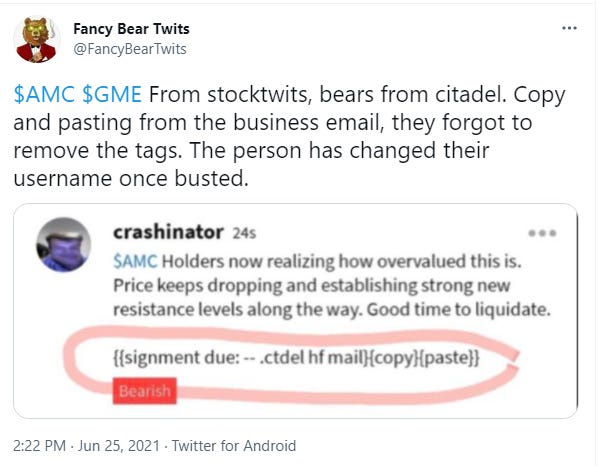

Here is a perfect example where a post on StockTwits (stock message board app), had code left from a bot as the person posting spam was too stupid to take out the tags before posting the message:

As such, a sudden move in price can change the sentiment of a company’s stock. When its going the moon, everyone on Twitter, Reddit, Yahoo finance, StockTwits etc loves the company and has rose colored glasses. You can’t find a bear thesis or negative comment anywhere and people are willing to FOMO buy at any price. But as soon as the stock corrects to the mean, the bots change their tune and become extremely negative. Hedge funds take profits on the way up, then flip the trade and pile in short to drive down the price to try to get in again at a lower price.

And lastly, you can always check sentiment by following the anointed one, Jim Cramer. I am sure if you are over 40, you have watched Jim Cramer scream “BUY BUY BUY” or “SELL SELL SELL” at you with zero analysis.

With so many hedge fund eyeballs on Jim and his show, algorithms use Cramer as a contra-indicator. When he says BUY, the algos react negatively and trim their position. The trade has likely ended and it’s time to take some profits. When he says SELL, the algos react positively, given its likely a short term bottom and time to scoop up some cheap shares. As the saying goes, “The easiest way to make money is to be inverse Cramer” given he tells you to buy the top and sell the bottom.

Cramer can’t even beat the S&P 500 study finds: Jim Cramer doesn’t beat the market

Here are some graphs if you don’t believe me. Several years of back tested data

Final Thoughts/ Conclusion

Lots of rules are changing behind the scenes and no one really knows how they will be enforced. But one thing is for certain, none of these government agencies want to be complicit in hedge fund crimes or have to pay up given their horrible risk management (examples include Archegos, etc.). And as hedge funds continue to blow up, other funds are manipulating retail investor communication channels, desperately trying to pump and dump their stocks. It’s so blatant now maybe the SEC will actually do something for once? I doubt it.

*Update from April 2021: Per FINRA, margin debt is continuing to climb ($861B in May 2021, which is around a $40B increase from March 2021). Even after the Archegos fiasco, and Credit Suisse getting taken to the cleaners, hedge funds are still loading up on margin debt, just at a reduced rate of increase compared to 2020.

*Update from last month: Several members from the very popular eSports team, Faze Clan, were outright dropped or suspended for promoting crypto scam, Save the Kids Coin, to their fans, which duped teenagers into buying since 1% of the fees went to some shady “charity”. Scamming fans with a coin that attempts to save kids. Pretty disgusting tactic by these influencers. Don’t worry, they all said #NotFinancialAdvice